Markets fell this week as the world tries to contain the spread of the Coronavirus. Utilities led the S&P sectors for the second consecutive week, finishing ahead of Real Estate and Technology to round out the strongest sectors. Markets are anxiously awaiting developments regarding the spread of the Coronavirus as some experts fear that the spread of the new disease could become a global epidemic.

European indices declined as well this week, with most major indices returning negative results. Japanese equities returned negative performance as well, spoiling recent upward trends. World indices are all displaying fear of the possibility of a global health crisis.

Markets retreated this week, with almost all major indices bringing in negative returns. Fears concerning global stability and health are an unexpected factor in asset values, and the recent volatility serves as a great reminder of why it is so important to remain committed to a long-term plan and maintain a well-diversified portfolio. When stocks were struggling to gain traction last month, other asset classes such as gold, REITs, and US Treasury bonds proved to be more stable. flashy news headlines can make it tempting to make knee-jerk decisions, but sticking to a strategy and maintaining a portfolio consistent with your goals and risk tolerance can lead to smoother returns and a better probability for long-term success.

Chart of the Week

The US Dollar traded above its 100 day moving average for the first time since November this week. The increase in USD strength highlights fears surrounding the virus outbreak in China, as investors and traders hide in dollar assets and positions for cover.

Market Updates

Equities

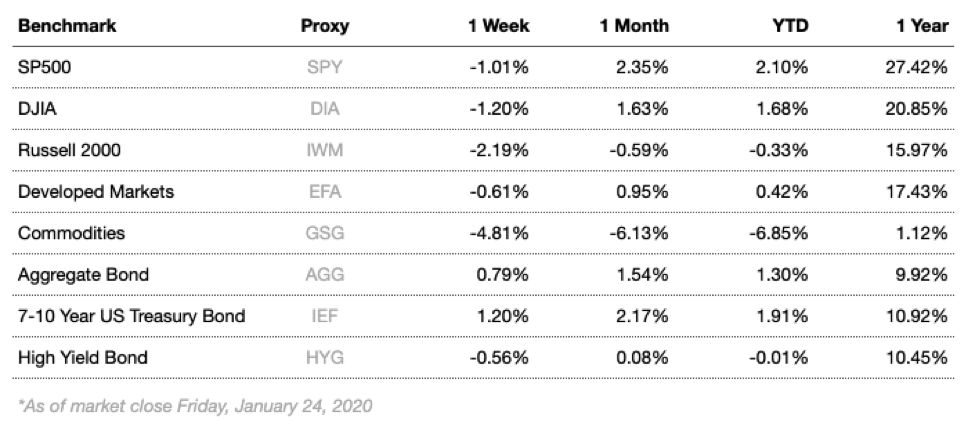

Broad equity markets finished the week negative, with major large cap indices outperforming small cap. Recent fears have outweighed trade developments and holiday sales data, pushing indices down.

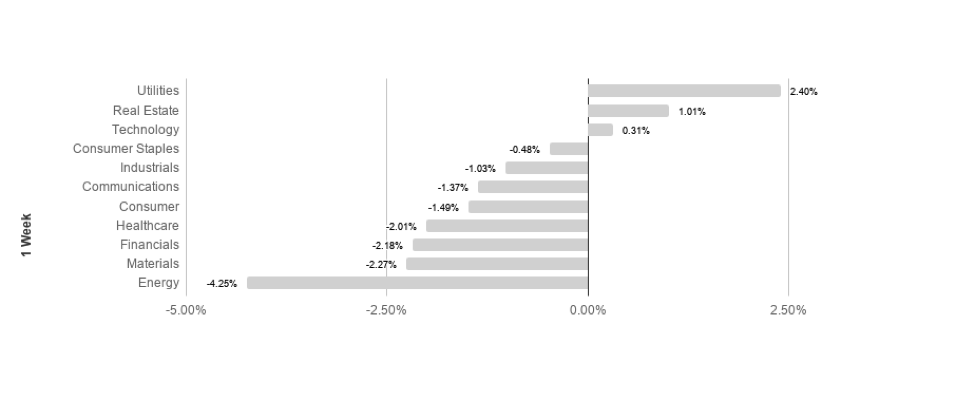

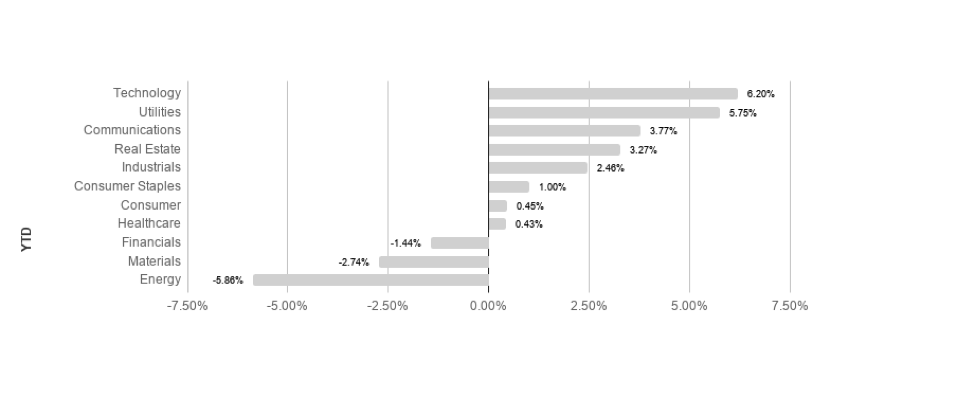

S&P sectors were mostly negative this week, with only three sectors returning positive performance. Utilities and real estate led the positive sectors returning 2.4% and 1.01% respectively. Energy and materials declined the most, falling -4.25% and -2.27% respectively. Technology has the lead so far YTD, returning 6.20% in 2020.

Commodities

Commodities declined this week, driven by losses in oil and natural gas. Oil markets have been highly volatile, with investors focusing on geopolitical tension and global demand concerns. The recent tensions between the U.S. and Iran have receded significantly, leading to fewer fears that an escalation could lead to supply disruptions. The possible impact of the virus outbreak in China is the most recent factor, as investors fear declining public health could hurt demand.

Gold climbed slightly, finishing over the $1500/oz mark for the fifth consecutive week. Focus for gold has shifted to global growth and public health concerns, as geopolitical tensions seem to be fading from investor focus.

Bonds

The 10-year Treasury yields fell from 1.82%to 1.68% while traditional bond indices rose. Treasury yields fell as investors fear the prospect of a global virus outbreak. The 10-2 year yield spreads tightened significantly. Treasury yields will continue to be a focus as analysts watch for signs of changing market conditions.

High-yield bond yields rose over the week, causing spreads to loosen. High-yield bonds are likely to remain volatile in the short to intermediate term as the Fed has taken a neutral monetary stance and investors weigh risk factors, likely driving increased volatility.

Lesson to Be Learned

“Investment is most successful when it is most businesslike.”

-Ben Graham

It can be easy to become distracted from our long-term goals and chase returns when markets are volatile and uncertain. It is because of the allure of these distractions that having a plan and remaining disciplined is mission critical for long term success. Focusing on the long-run can help minimize the negative impact emotions can have on your portfolio and increase your chances for success over time.

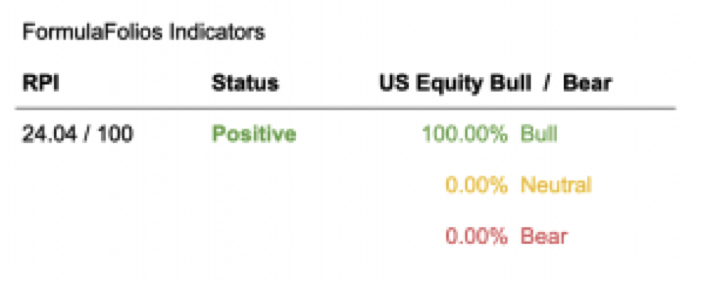

FormulaFolios Indicators

Here are two simple indicators we share that help you see how the economy is doing (we call this the Recession Probability Index, or RPI), as well as if the US Stock Market is strong (bull) or weak (bear).

In a nutshell, we want the RPI to be low on the scale of 1 to 100. For the US Equity Bull/Bear indicator, we want it to read least 66.67% bullish. When those two things occur, our research shows market performance is strongest and least volatile.

The Recession Probability Index (RPI) has a current reading of 24.04, forecasting further economic growth and not warning of a recession at this time. The Bull/Bear indicator is currently 100% bullish – 0% bearish, meaning the indicator shows there is a slightly higher than average likelihood of stock market increases in the near term (within the next 18 months).

The Week Ahead

It could be an interesting week as the economic calendar is heavy on major releases, including consumer confidence, durable goods, and Fed releases. U.S. markets will likely still be digesting the potential impact of the Coronavirus outbreak and weighing it against economic factors.

More to come soon. Stay tuned.