Markets regained some ground this week as new economic data provided encouraging insight into the economic recovery. Retail sales, manufacturing, and housing data released this week all produced improvements, each vastly outperforming consensus expectations. Recent surges in economic activity have provided a flash point between bulls and bears, with the latter dismissing or being suspicious of recent improvements in economic data. Bears point to bigger picture outlooks like GDP and total unemployment as evidence that the recovery is not likely to be completed quickly. Further economic data in the coming weeks and months will hopefully shed further light on true economic conditions and help provide an accurate outlook for the pace of the economic recovery.

Overseas, markets also improved, likely responding favorably to U.S. economic indicators as well as further economic reopenings. All major European indices returned positive results for the week. Japanese equities returned positive performance as well, but much more modest numbers than American and European counterparts. As global economies continue to reopen, the prevalence of Covid-19 headlines are likely to start to recede, and focus is likely to dial in more on global recovery efforts.

Markets rose this week, with all major equity indices bringing in positive returns. Fears concerning global stability and health are an unexpected factor in asset values, and the recent volatility serves as a great reminder of why it is so important to remain committed to a long-term plan and maintain a well-diversified portfolio. When stocks were struggling to gain traction last month, other asset classes such as gold, REITs, and US Treasury bonds proved to be more stable. flashy news headlines can make it tempting to make knee-jerk decisions, but sticking to a strategy and maintaining a portfolio consistent with your goals and risk tolerance can lead to smoother returns and a better probability for long-term success.

Chart of the Week

Equities have been under increasing scrutiny recently for high prices relative to future earnings expectations. Until expectations line up better with asset values, bears are likely to continue to voice concern over the prices of stocks.

Market Update

Equities

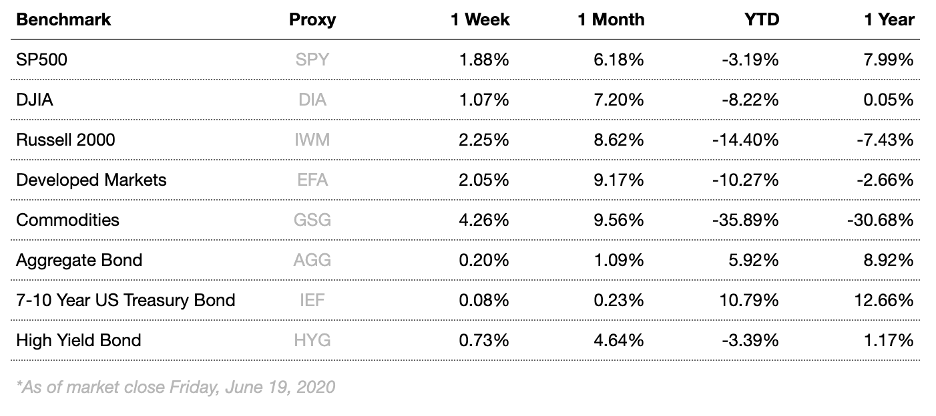

Broad market equity indices finished the week up, with major large cap indices underperforming small cap. Economic data has impressed, but the global recovery still has a long way to go to regain lost jobs and output.

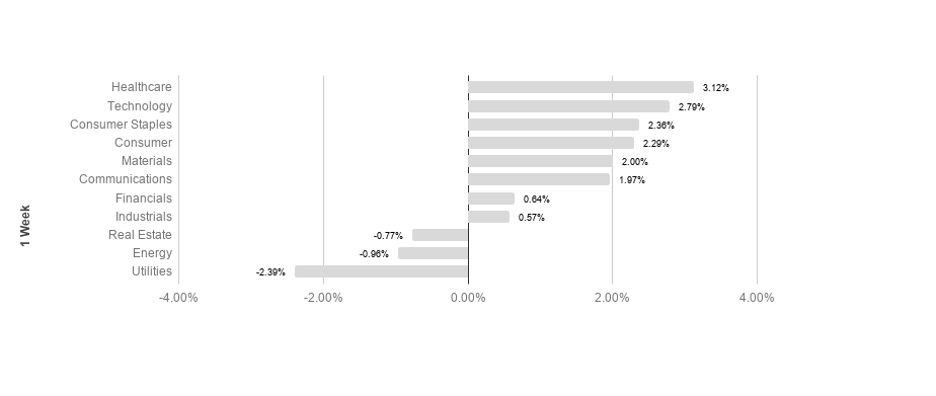

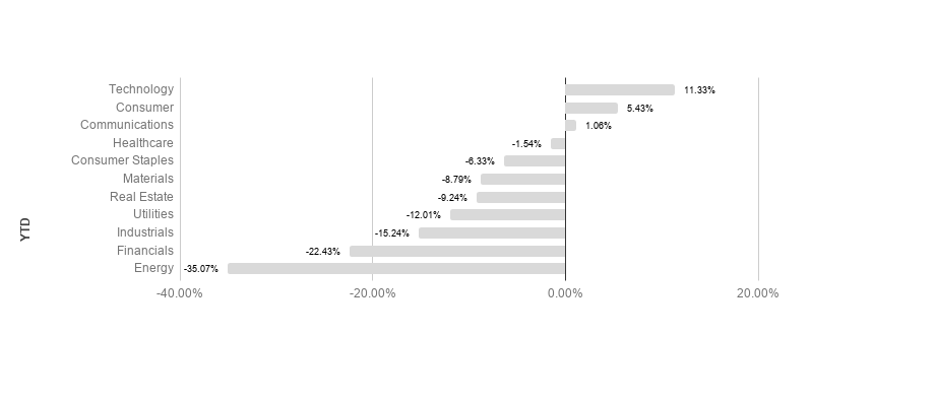

S&P sectors returned mostly positive results this week, as broad market movements showed support for multiple sectors. Healthcare led the best performing sectors, followed by technology, returning 3.12% and 2.79% respectively. Energy and utilities performed the worst, posting -0.96% and -2.39% respectively. Technology leads the pack so far YTD, returning 11.33% in 2020.

Commodities

Commodities rose this week, driven by large gains in oil. Oil markets have been highly volatile, with investors focusing on output and consumption concerns. Recent economic improvements have improved demand outlook, as summer is likely to increase consumption while normal economic activities should continue recovering. Demand is still likely to recover slowly however, as economic activity is not likely to recover instantly. Oil supplies have shrunk dramatically, as operating oil rigs have shrunk by nearly 70% since last year, further helping oil prices to recover.

Gold rose this week as markets reacted to encouraging economic data. Gold is a common “safe haven” asset, typically rising during times of market stress. Focus for gold has shifted to global macroeconomics and recovery efforts. Weakening real currency values resulting from massive stimulus measures may further support gold prices.

Bonds

Yields on 10-year Treasuries fell slightly from 0.70% to 0.69% while traditional bond indices rose. Treasury yield movements reflect general risk outlook, indicating that risk appetites may have levelled out this week. Treasury yields will continue to be a focus as analysts watch for signs of changing market conditions.

High-yield bonds fell this week, causing spreads to loosen. High-yield bonds are likely to remain volatile in the short to intermediate term as the Fed has adopted a remarkably accommodative monetary stance and investors flee economic risk factors, likely driving increased volatility.

Lesson to Be Learned

“Spend each day trying to be a little wiser than you were when you woke up.”

-Charlie Munger

It can be easy to become distracted from our long-term goals and chase returns when markets are volatile and uncertain. It is because of the allure of these distractions that having a plan and remaining disciplined is mission critical for long term success. Focusing on the long-run can help minimize the negative impact emotions can have on your portfolio and increase your chances for success over time.

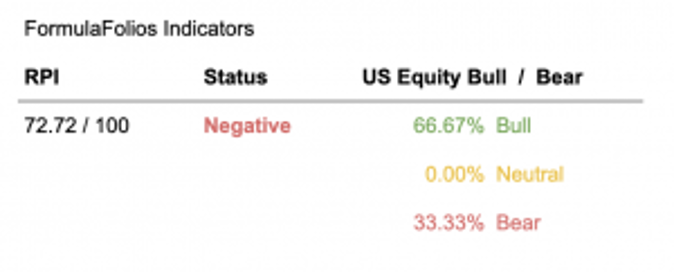

We have two simple indicators we share that help you see how the economy is doing (we call this the Recession Probability Index, or RPI), as well as if the US Stock Market is strong (bull) or weak (bear).

In a nutshell, we want the RPI to be low on the scale of 1 to 100. For the US Equity Bull/Bear indicator, we want it to read least 66.67% bullish. When those two things occur, our research shows market performance is strongest and least volatile.

The Recession Probability Index (RPI) has a current reading of 72.72, forecasting a higher potential for an economic contraction (warning of recession risk). The Bull/Bear indicator is currently 66.67% bullish – 33.33% bearish, meaning the indicator shows there is a slightly higher than average likelihood of stock market increases in the near term (within the next 18 months).

The Week Ahead

This week sees updated PMI, durable goods, and consumer spending numbers, all of which should help provide some valuable insight into the economic recovery process. Improvements in the manufacturing sector could be largely supportive, as the sector has been hit especially hard by the global economic slowdown.

More to come soon. Stay tuned.