Stocks fell this week for a fourth straight week, continuing the September swoon trend. Economic data was mixed this week, marked by an expectations miss in durable goods orders but stronger than expected manufacturing and services PMI. Unemployment claims continue to trend downwards, likely indicating slowly recovering labor markets. Unemployment claims are likely to remain elevated for several more weeks, but will likely continue to trend downwards. The unemployment rate remains below the peak of the great recession during 2008-2009. The persistently high case rates of COVID-19 in the U.S. remains concerning; while infection rates seemed to be slowly but steadily decreasing, most recent infection numbers indicate that numbers may be on the rise again, a change likely related to schools reopening. Encouragingly, negotiations between House Democrats and the Trump administration have resumed with the intent of passing an additional stimulus package. While both sides are still far apart on the size of the package, both sides are claiming negotiations have resumed in good faith. Even if the Trump administration can come to an agreement with the Democrat-controlled House, it remains unlikely that a Republican-controlled Senate will allow a large stimulus to pass.

Overseas, developed markets and emerging markets both fell substantially. European indices returned negative results for the week. Japanese equities also returned negative performance. As global economies continue to work towards business as usual, analysts are hoping COVID-19 infections are brought further under control so that focus can dial in more on global recovery efforts.

Markets declined this week, with most equity indices bringing in negative returns. Fears concerning global stability and health are an unexpected factor in asset values, and the recent volatility serves as a great reminder of why it is so important to remain committed to a long-term plan and maintain a well-diversified portfolio. When stocks were struggling to gain traction last month, other asset classes such as gold, REITs, and US Treasury bonds proved to be more stable. flashy news headlines can make it tempting to make knee-jerk decisions, but sticking to a strategy and maintaining a portfolio consistent with your goals and risk tolerance can lead to smoother returns and a better probability for long-term success.

Chart of the Week

Nondefense capital goods excluding aircraft has reached the highest levels seen since 2018. Investment in capital is a strong leading indicator of manufacturing, making the high level of purchases a welcome surprise as the economy works to recover from the pandemic.

Market Update

Equities

Broad market equity indices finished the week down, with major large cap indices outperforming small cap. Economic data has progressed, but the global recovery still has a long way to go to regain lost jobs and output.

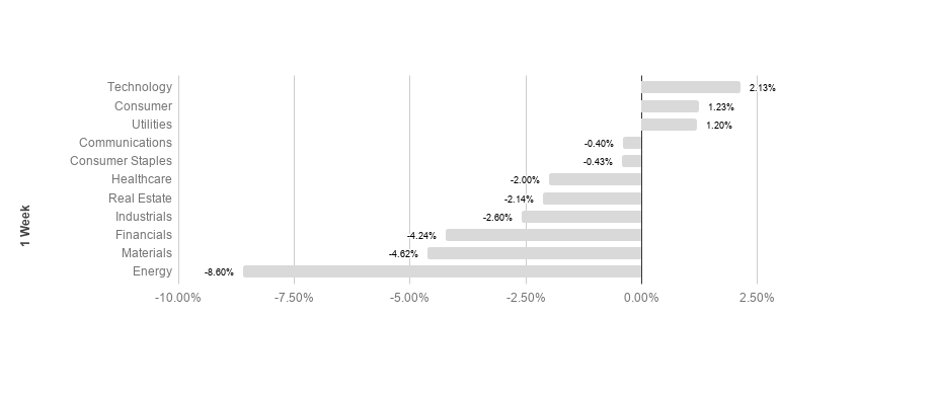

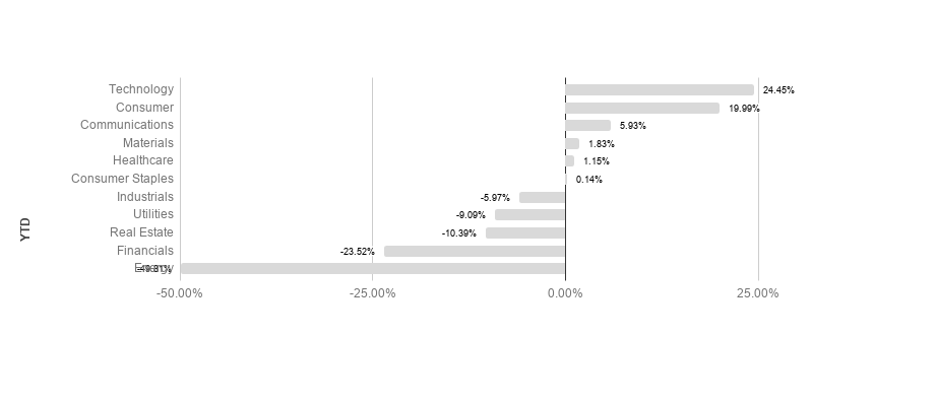

S&P sectors returned mixed results this week. Technology and consumer discretionary outperformed, returning 2.13% and 1.23% respectively. Materials and energy performed the worst, posting -4.62% and -8.60% respectively. Technology leads the pack so far YTD, returning 24.45% in 2020.

Commodities

Commodities fell this week, driven by falling metal and oil prices. Energy markets have been highly volatile, with oil investors focusing on output and consumption concerns. Demand is still likely to recover slowly however, as economic activity is not likely to recover instantly from the pandemic. On the supply side, operating oil rigs are still well under early 2020 numbers.

Gold fell this week as the precious metal lost value as the US dollar strengthened. Gold is a common “safe haven” asset, typically rising during times of market stress. Focus for gold has shifted to global macroeconomics and recovery efforts.

Bonds

Yields on 10-year Treasuries fell this week from 0.69% to 0.65% while traditional bond indices fell. Treasury yield movements reflect general risk outlook, and tend to track overall investor sentiment. Treasury yields will continue to be a focus as analysts watch for signs of changing market conditions.

High-yield bonds fell this week, causing spreads to loosen. High-yield bonds are likely to remain volatile in the short to intermediate term as the Fed has adopted a remarkably accommodative monetary stance and investors flee economic risk factors, likely driving increased volatility.

Lesson to Be Learned

“The individual investor should act consistently as an investor and not as a speculator. This means … that he should be able to justify every purchase he makes and each price he pays by impersonal, objective reasoning that satisfies him that he is getting more than his money’s worth for his purchase.”

-Ben Graham

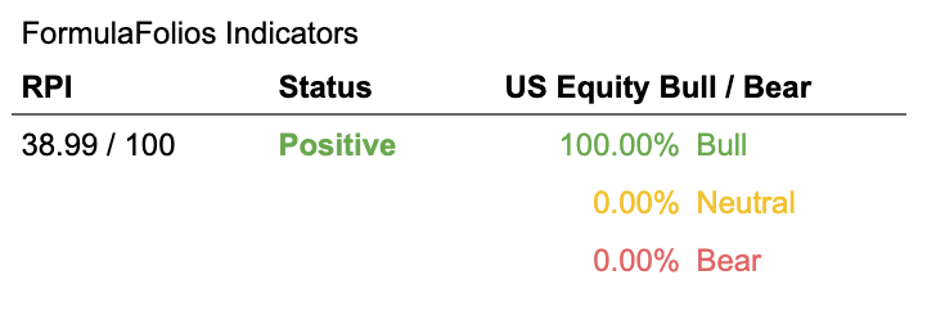

We have two simple indicators we share that help you see how the economy is doing (we call this the Recession Probability Index, or RPI), as well as if the US Stock Market is strong (bull) or weak (bear).

In a nutshell, we want the RPI to be low on a scale of 1 to 100. For the US Equity Bull/Bear indicator, we want it to read at least 66.67% bullish. When those two things occur, our research shows market performance is typically stronger, with less volatility.

The Recession Probability Index (RPI) has a current reading of 38.99, forecasting a lower potential for an economic contraction (warning of recession risk). The Bull/Bear indicator is currently 100% bullish, meaning the indicator shows there is a slightly higher than average likelihood of stock market increases in the near term (within the next 18 months).

It can be easy to become distracted from our long-term goals and chase returns when markets are volatile and uncertain. It is because of the allure of these distractions that having a plan and remaining disciplined is mission critical for long term success. Focusing on the long-run can help minimize the negative impact emotions can have on your portfolio and increase your chances for success over time.

The Week Ahead

This week will see the most up-to-date employment numbers released on Friday. Expectations are for hiring to have cooled further, and for unemployment to come in at 8.2%, a 0.2% drop from the previous month.

More to come soon. Stay tuned.