Thanksgiving week has come and gone, officially kicking off the Christmas season. Stocks rose this week as markets continue to be encouraged by the progress in COVID-19 vaccine trials. Globally, COVID-19 infections continue to increase. New daily infections in the U.S. remain stubbornly above 100K. Economic data was mostly positive this week with spending, housing and manufacturing all beating expectations. Unemployment claims have been choppy but moving downwards, likely indicating slowly recovering labor markets. Recently, unemployment declines have slowed somewhat, prompting questions as to whether or not the recovery may be coming to a halt. The persistently high and increasing case rates of COVID-19 in the U.S. remain concerning, and restrictive measures have begun being reinstated in some areas. The increase in cases has been statistically correlated with schools reopening, and as the flu season sets in transmission rates may increase even further.

Overseas, developed markets and emerging markets both rose. Global indices continue to respond well to reports of an effective vaccine, likely increasing hopes that lockdowns in Europe could be ended sooner than later.

Markets performed well this week, with equity indices bringing in positive returns. Fears concerning global stability and health are an unexpected factor in asset values, and the recent volatility serves as a great reminder of why it is so important to remain committed to a long-term plan and maintain a well-diversified portfolio. When stocks were struggling to gain traction last month, other asset classes such as gold, REITs, and US Treasury bonds proved to be more stable. flashy news headlines can make it tempting to make knee-jerk decisions, but sticking to a strategy and maintaining a portfolio consistent with your goals and risk tolerance can lead to smoother returns and a better probability for long-term success.

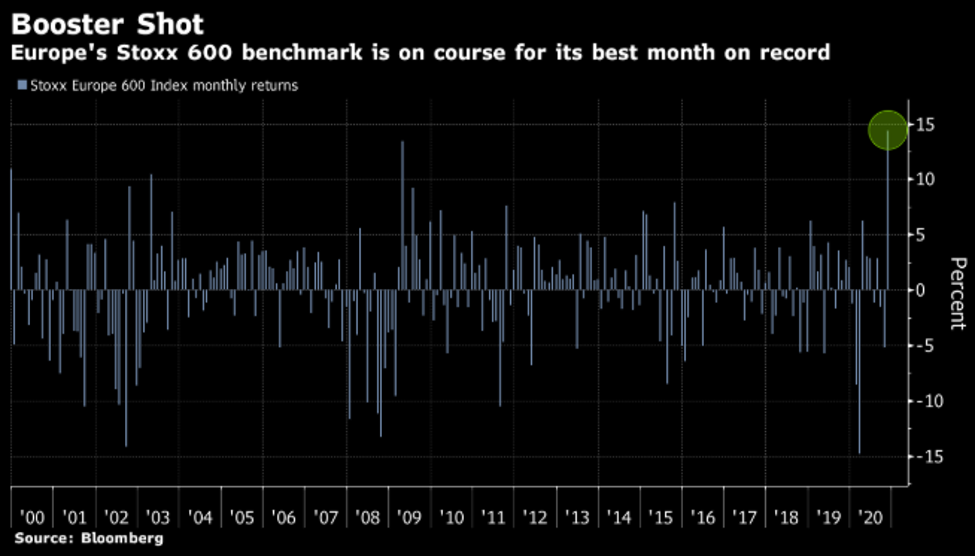

Chart of the Week

European stocks have skyrocketed during November, and may even set a new record for a monthly performance mark. Europe was battered in the fall by resurgent COVID-19 spread, making recent news of effective vaccines extremely supportive for European stocks.

Market Update

Equities

Broad market equity indices finished the week mostly positive, with major large cap indices underperforming small cap. Economic data has been solid, but the global recovery is still threatened by COVID-19.

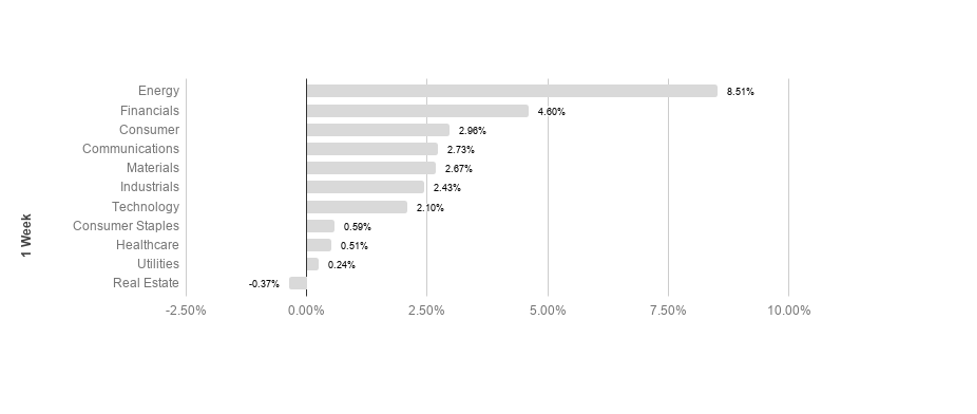

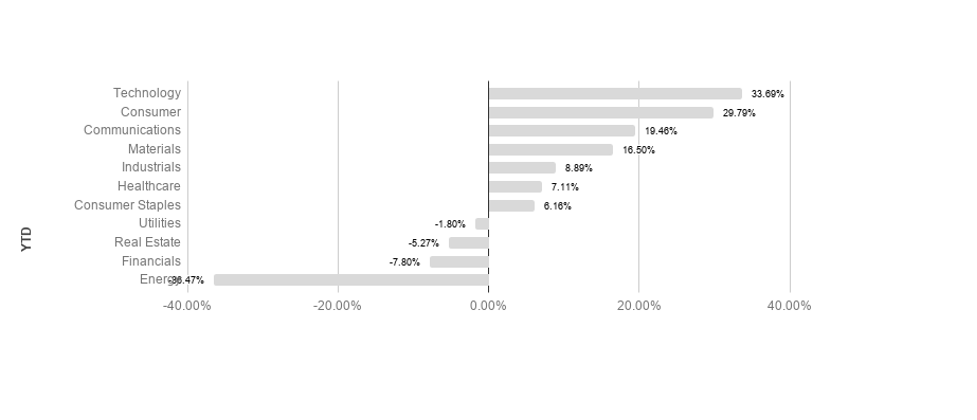

S&P sectors returned mostly positive results this week. Energy and financials outperformed, returning 8.51% and 4.60% respectively. Utilities and real estate underperformed, posting 0.24% and -0.37% respectively. Technology leads the pack so far YTD, returning 33.69% in 2020.

Commodities

Commodities rose this week, driven by a substantial jump in oil prices. Oil markets have begun to show a significant responsiveness to the status of vaccine development efforts, as normal economic conditions are critical to energy consumption. Energy markets have been highly volatile, with oil investors focusing on output and consumption concerns. Demand is still likely to recover slowly however, and recent lockdown restrictions in Europe have raised doubts as to whether demand is going to continue in a positive direction. On the supply side, operating oil rigs are still well under early 2020 numbers, but trending upwards.

Gold fell this week even as the U.S. dollar weakened. Gold is a common “safe haven” asset, typically rising during times of market stress. Focus for gold has shifted to global macroeconomics and recovery efforts. Recent declines in the precious metal could indicate increasing risk appetites.