Markets fell this week even as economic data was largely positive. Consumer confidence rose, while durable goods orders and unemployment claims both beat analyst expectations. On the federal stimulus front, it appears that a bill is likely to pass through congress over the coming weeks. The $1.9 trillion package has had some of the more controversial and partisan elements removed to help it clear congressional hurdles. On the COVID-19 front, U.S. infections now may be plateauing, or possibly receding at a slower pace. The 7 day moving average remains below 70K daily infections, but infections rates were little changed over the week. Some additional good news on the battle against the pandemic comes in the form of an additional approved vaccine from Johnson and Johnson, and the company is expected to be able to deliver 4 million doses of their one-shot vaccine a week.

Overseas, developed markets and emerging markets both fell. European and Japanese markets both declined. Improving prospects against the pandemic should continue to help lift markets globally over time.

Markets fell this week as investors continue to assess the state of the global economy. While fears concerning global stability and health appear to be in decline, the recent volatility serves as a great reminder of why it is so important to remain committed to a long-term plan and maintain a well-diversified portfolio. When stocks were struggling to gain traction last month, other asset classes such as gold, REITs, and US Treasury bonds proved to be more stable. flashy news headlines can make it tempting to make knee-jerk decisions, but sticking to a strategy and maintaining a portfolio consistent with your goals and risk tolerance can lead to smoother returns and a better probability for long-term success.

Chart of the Week

February was a rough month for investment grade bonds, as yields rose by the highest percentages since March 2020 during the pandemic sell off. Fears of inflation and faster than predicted economic recovery have likely helped drive up yields.

Market Update

Equities

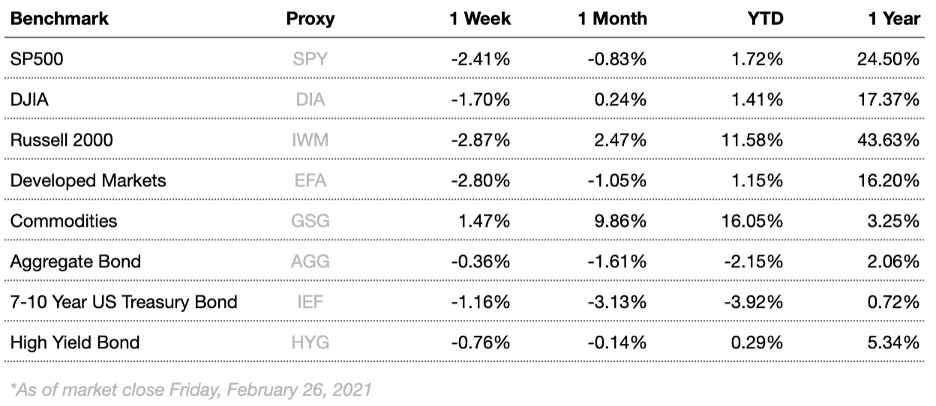

Broad market equity indices finished the week down, with major large cap indices outperforming small cap. Economic data has been encouraging, but the global recovery has a long way to go to recover from COVID-19 lockdowns.

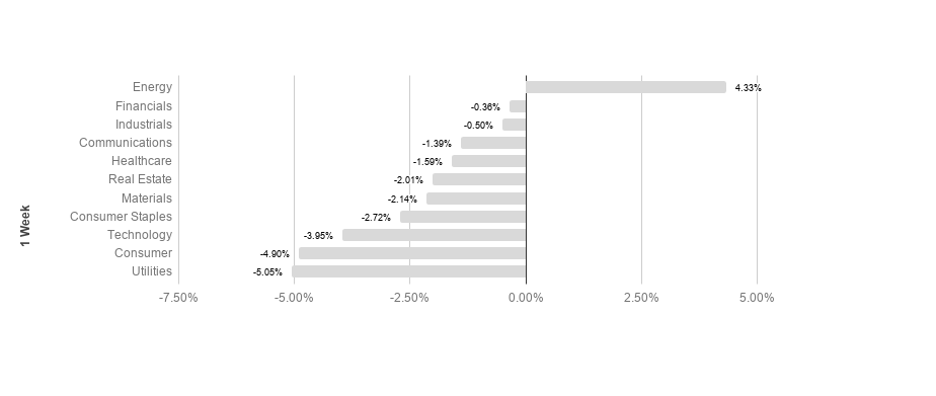

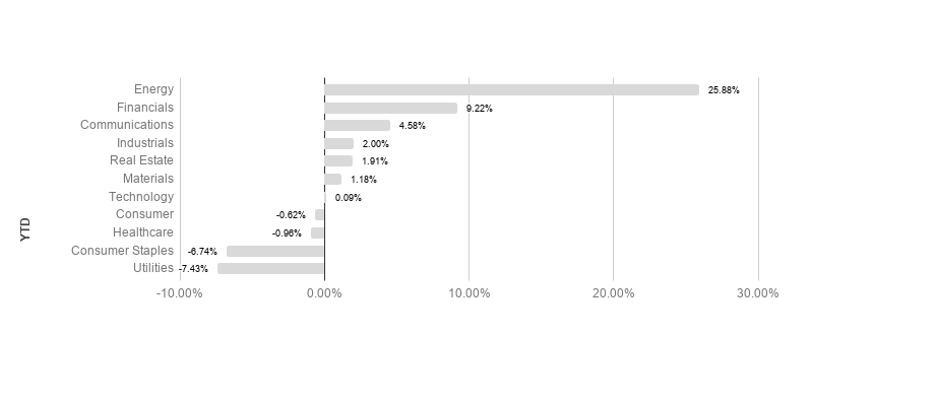

S&P sectors returned mostly negative results this week. Energy and financials outperformed, returning 4.33% and -0.36% respectively. Consumer discretionary and utilities underperformed, posting -4.90% and -5.05% respectively. Energy maintains its lead 2021 with a 25.88% return.

Commodities

Oil rose this week as oil markets continue to solidify. Energy markets have been highly volatile in the COVID era, but it appears that further price support may be on the horizon given recent developments. Demand is still low compared to early 2020, but as vaccinations proliferate, lockdown restrictions in Europe as well as the U.S. should start to loosen, helping support recovery. On the supply side, operating oil rigs are still well under early 2020 numbers, but trending upwards. In addition to supply and demand, a weakening dollar is likely to have a large impact on commodity prices.

Gold fell this week as the U.S. dollar strengthened. Gold is a common “safe haven” asset, typically rising during times of market stress. Focus for gold has shifted again to include not just global macroeconomics surrounding COVID-19 damage and recovery efforts, but also U.S. dollar value.

Bonds

Yields on 10-year Treasuries rose this week from 1.336 to 1.405 while traditional bond indices fell. Treasury yield movements reflect general risk outlook, and tend to track overall investor sentiment. Treasury yields will continue to be a focus as analysts watch for signs of changing market conditions.

High-yield bonds fell this week as spreads loosened. High-yield bonds are likely to remain more stable in the short to intermediate term as the Fed has adopted a remarkably accommodative monetary stance, vaccines continue to be administered at high rates, and major economic risk factors subside, likely helping stabilize volatility.

Lesson to Be Learned

“Don’t look for the needle in the haystack. Just buy the haystack.”

-John Bogle

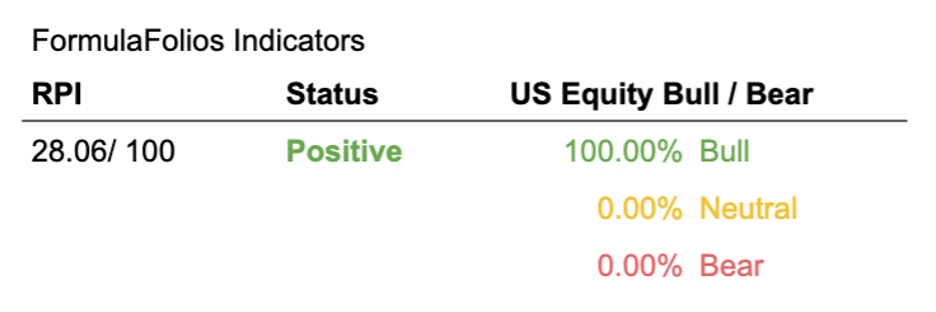

FormulaFolios has two simple indicators we share that help you see how the economy is doing (we call this the Recession Probability Index, or RPI), as well as if the US Stock Market is strong (bull) or weak (bear).

In a nutshell, we want the RPI to be low on a scale of 1 to 100. For the US Equity Bull/Bear indicator, we want it to read at least 66.67% bullish. When those two things occur, our research shows market performance is typically stronger, with less volatility.

The Recession Probability Index (RPI) has a current reading of 28.06, forecasting a lower potential for an economic contraction (warning of recession risk). The Bull/Bear indicator is currently 100% bullish, meaning the indicator shows there is a slightly higher than average likelihood of stock market increases in the near term (within the next 18 months).

It can be easy to become distracted from our long-term goals and chase returns when markets are volatile and uncertain. It is because of the allure of these distractions that having a plan and remaining disciplined is mission critical for long term success. Focusing on the long-run can help minimize the negative impact emotions can have on your portfolio and increase your chances for success over time.

The Week Ahead

This week we will see updated official unemployment rates as well as non-farm payroll hiring. There will also be updated PMI numbers as well as a speech by Fed Chair Powell.

More to come soon. Stay tuned.