Markets mostly rose this week as new economic data was sparse. Initial unemployment claims disappointed, highlighting the difficulties still faced by the labor market. Prices continue to rise, as the most recent produce price index came in well above expectations. Overall, the economy seems well positioned to perform exceptionally in 2021 based on the most recent economic data. New COVID-19 infections moved slightly higher again this week, with 7 day moving averages increasing by around 3K a day over the prior week. The past three weeks have some analysts seeing cause for concern, as new infections seem to have plateaued.

Overseas, developed markets outperformed emerging markets. European indices were mixed, with Japanese markets returning a strong positive week. Improving prospects against the pandemic as well as improved prospects for economic recovery should continue to help lift markets globally over time.

Markets were mixed this week as investors continue to assess the state of the global economy. While fears concerning global stability and health appear to be in decline, the recent volatility serves as a great reminder of why it is so important to remain committed to a long-term plan and maintain a well-diversified portfolio. When stocks were struggling to gain traction last month, other asset classes such as gold, REITs, and US Treasury bonds proved to be more stable. flashy news headlines can make it tempting to make knee-jerk decisions, but sticking to a strategy and maintaining a portfolio consistent with your goals and risk tolerance can lead to smoother returns and a better probability for long-term success.

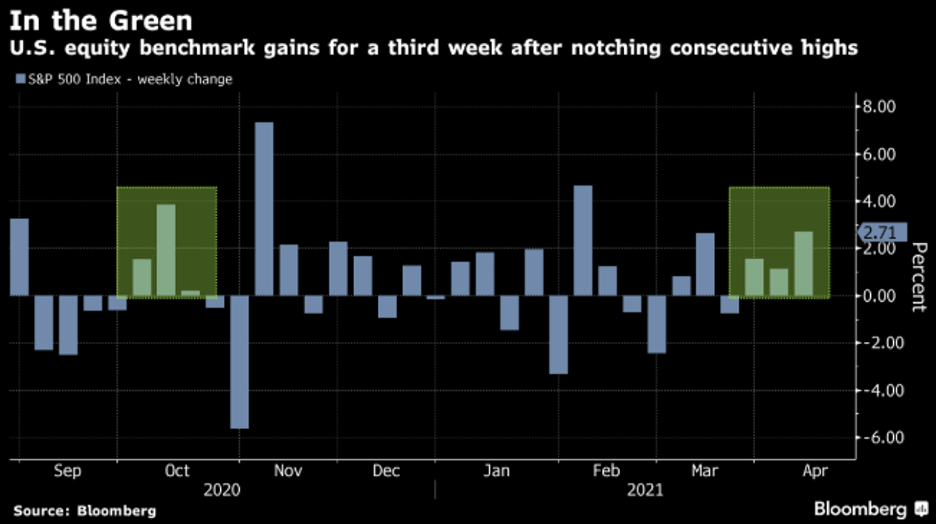

Chart of the Week

The S&P 500 has been on a hot streak the last three weeks, registering fresh all time highs consecutively. Markets have been helped by strong manufacturing and housing data, as well as better than expected hiring in March.

Market Update

Equities

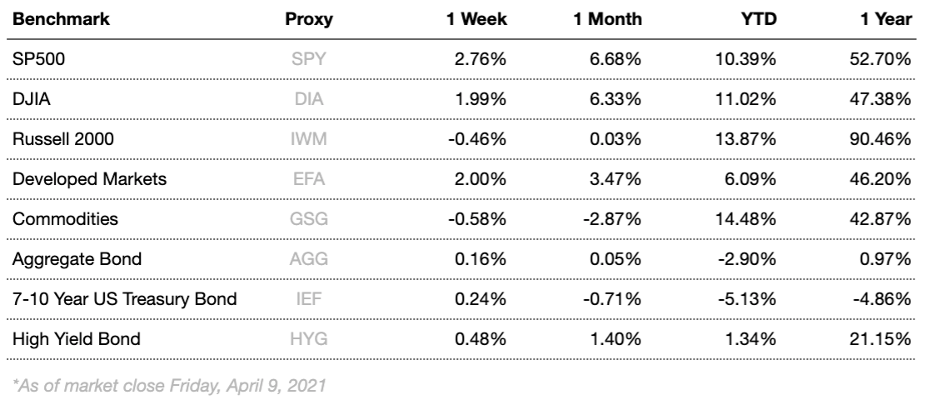

Broad market equity indices finished the week mixed, with major large cap indices outperforming small cap. Economic data has been mostly encouraging, but the global recovery has a long way to go to recover from COVID-19 lockdowns.

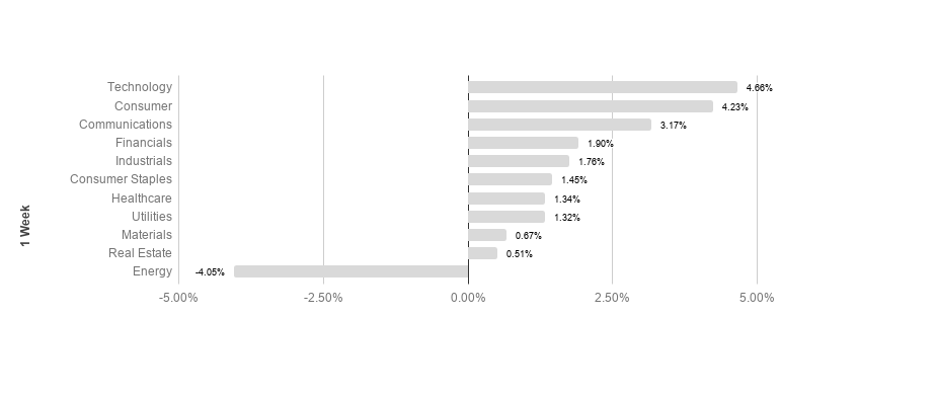

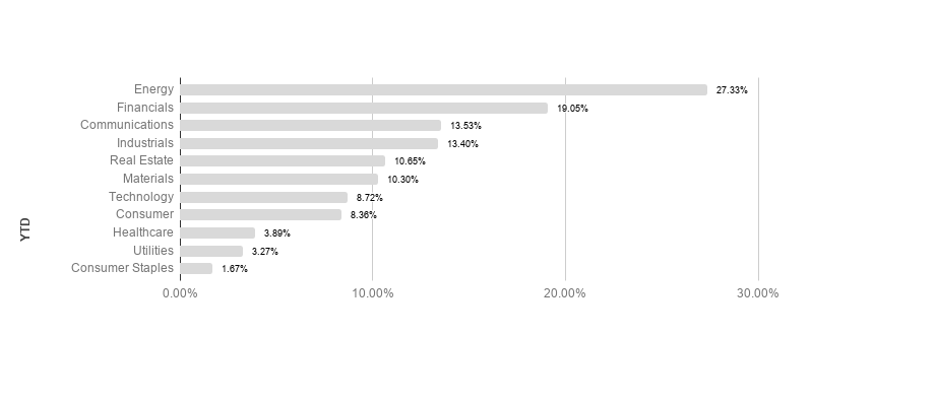

S&P sectors returned almost exclusively positive results this week. Technology and consumer discretionary outperformed, returning 4.66% and 4.23% respectively. Real estate and energy underperformed, posting 0.51% and -4.05% respectively. Energy maintains its lead in 2021 with a 27.33% return.

Commodities

Oil fell this week even as crude oil inventories fell more than expected. Energy markets have been highly volatile in the COVID era, but it appears that stability may be more of the norm given recent market fundamentals. Demand is still low compared to early 2020, but as vaccinations proliferate, lockdown restrictions in Europe as well as the U.S. should start to loosen, helping support recovery. On the supply side, operating oil rigs are still well under early 2020 numbers, but trending upwards. In addition to supply and demand, a volatile dollar is likely to have a large impact on commodity prices.

Gold rose slightly this week as the U.S. dollar strengthened slightly. Gold is a common “safe haven” asset, typically rising during times of market stress. Focus for gold has shifted again to include not just global macroeconomics surrounding COVID-19 damage and recovery efforts, but also inflation and its possible impact on U.S. dollar value.

Bonds

Yields on 10-year Treasuries fell this week from 1.6699 to 1.6585 while traditional bond indices rose slightly. Treasury yield movements reflect general risk outlook, and tend to track overall investor sentiment. Recently, expected increases in future inflation risk have helped drive up yields. Treasury yields will continue to be a focus as analysts watch for signs of changing market conditions.

High-yield bonds rose this week as spreads tightened. High-yield bonds are likely to remain more stable in the short to intermediate term as the Fed has adopted a remarkably accommodative monetary stance, vaccines continue to be administered at high rates, and major economic risk factors subside, likely helping stabilize volatility.

Lesson to Be Learned

“Finding the best person or the best organization to invest your money is one of the most important financial decisions you’ll ever make.”

-Bill Gross

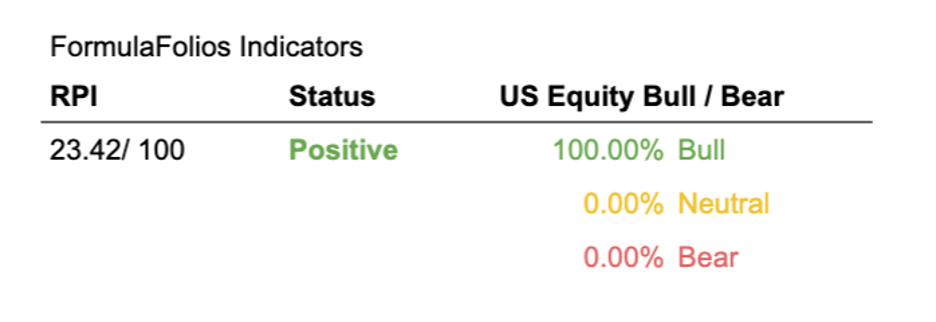

FormulaFolios has two simple indicators we share that help you see how the economy is doing (we call this the Recession Probability Index, or RPI), as well as if the US Stock Market is strong (bull) or weak (bear).

In a nutshell, we want the RPI to be low on a scale of 1 to 100. For the US Equity Bull/Bear indicator, we want it to read at least 66.67% bullish. When those two things occur, our research shows market performance is typically stronger, with less volatility.

The Recession Probability Index (RPI) has a current reading of 23.42, forecasting a lower potential for an economic contraction (warning of recession risk). The Bull/Bear indicator is currently 100% bullish, meaning the indicator shows there is a slightly higher than average likelihood of stock market increases in the near term (within the next 18 months).

It can be easy to become distracted from our long-term goals and chase returns when markets are volatile and uncertain. It is because of the allure of these distractions that having a plan and remaining disciplined is mission critical for long term success. Focusing on the long-run can help minimize the negative impact emotions can have on your portfolio and increase your chances for success over time.

The Week Ahead

This week will have updated CPI numbers as well as retail sales reflecting the month of March. The manufacturing sector sees updated empire state and Philly Fed manufacturing indices. The housing market will also see updates to NAHB numbers as well as housing starts and building permits.

More to come soon. Stay tuned.