Markets rose dramatically this week even as the novel coronavirus Covid-19 continued its spread, in spite of shutdowns and quarantines around the globe. Equities responded favorably to the passing of a $2.2 trillion federal stimulus package, conveying optimism that negative effects of the rising economic damages would be short-lived for the economy. In stark contrast to recent weeks, every sector returned positive performance. Utilities led the S&P sectors this week, finishing ahead of industrials and real estate to round out the strongest sectors. Just one week after markets officially entered bear market territory, prices reversed sharply to return to an official bull market. In spite of the market recovery, public anxiety is growing as the virus continues to spread. U.S. unemployment filings set a record this week, as 3.3 million Americans are out of work as a result of the economic shutdowns. Supply chains, store-front businesses, and consumer activity remain under extreme pressure. Investors are facing challenges to determine market impact as government actions to overcome the disease are constantly evolving.

Overseas, markets echoed U.S. indices, as European markets rose in spite of increasing infection rates. Italy has been hit especially hard by the virus, as they have the oldest average population in Europe. All major European indices returned positive results. Japanese equities also returned positive performance, outpacing all other developed economies with the highest weekly returns. New cases of the coronavirus have been growing at increasing rates in Europe, but investor optimism that the economic damage can be contained has supported equity markets.

Markets rose substantially this week, with all major equity indices bringing in positive returns. Fears concerning global stability and health are an unexpected factor in asset values, and the recent volatility serves as a great reminder of why it is so important to remain committed to a long-term plan and maintain a well-diversified portfolio. When stocks were struggling to gain traction last month, other asset classes such as gold, REITs, and US Treasury bonds proved to be more stable. flashy news headlines can make it tempting to make knee-jerk decisions, but sticking to a strategy and maintaining a portfolio consistent with your goals and risk tolerance can lead to smoother returns and a better probability for long-term success.

Chart of the Week

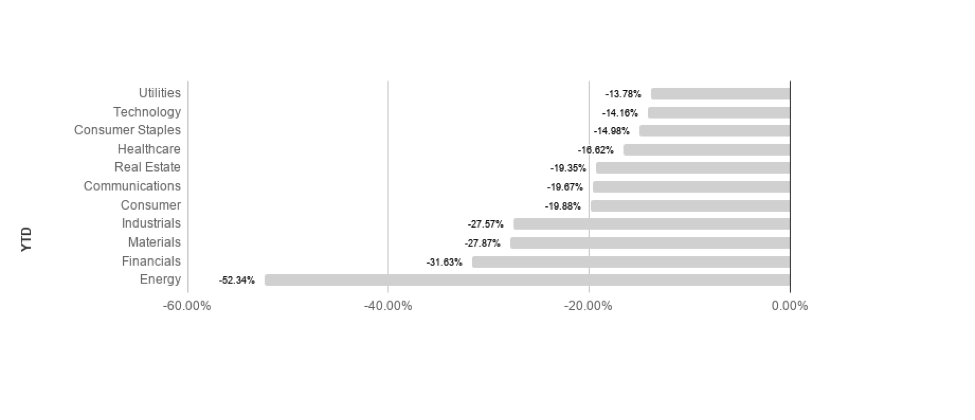

Since the outbreak of the Covid-19 coronavirus, the energy industry has taken a substantial hit. Not only are shutdowns impacting demand, but the price war between Saudi Arabia and Russia is hitting supply as well.

Market Update

Equities

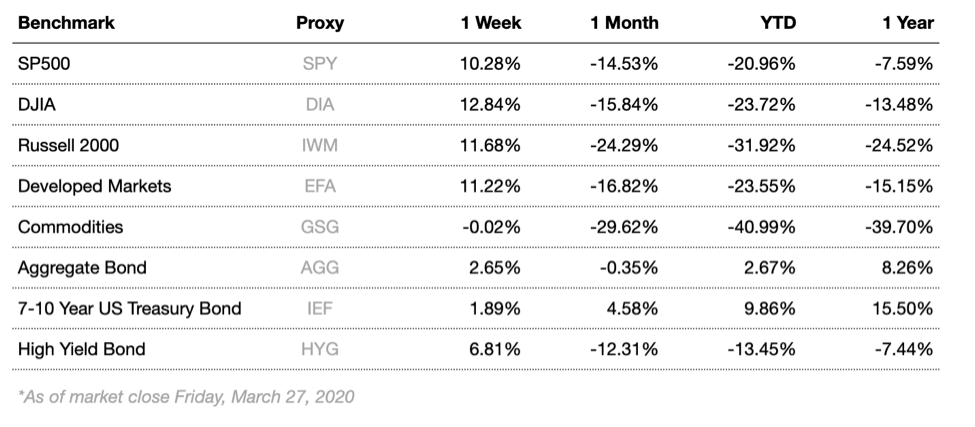

Broad market equity indices finished the week up, with major large cap indices performing comparably to small cap. Recent fears took a back seat to optimism this week, as prices rose considerably in response to federal stimulus. Economic data has begun to reflect the damage inflicted by the disease, as PMI (purchasing managers index) dropped and unemployment claims skyrocketed.

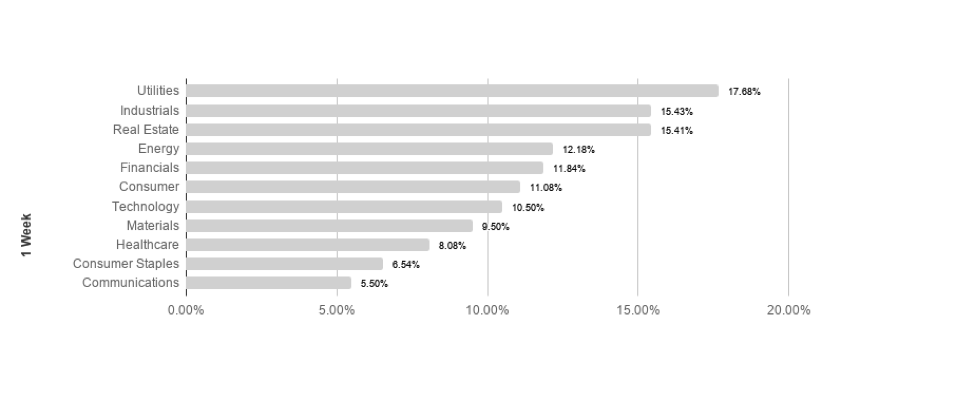

S&P sectors returned positive results this week, as broad market movements showed investors moving back into equities. Utilities and industrials led the best performing negative sectors, returning 17.68% and 15.43% respectively. Communications and consumer staples had the smallest gains, posting 5.50% and 6.54% respectively. Utilities leads the pack so far YTD, returning -13.78% in 2020.

Commodities

Commodities were flat this week, held to meager losses by competing losses in oil versus gains in gold. Oil markets have been highly volatile, with investors focusing on geopolitical tension and global demand concerns. Global fears surrounding the virus outbreak have further stoked demand concerns, as a significant impact on energy demand is expected as a result. Additional pressure has been added to oil markets as Saudi Arabia and Russia have entered into a price war over production disputes.

Gold jumped this week as fear surrounding the coronavirus increased. Gold is a common “safe haven” asset, typically rising during times of market stress. Additionally, fears of inflation have depressed the U.S. dollar, resulting in appreciating gold prices. Focus for gold has shifted to global macroeconomics and public health concerns.

Bonds

Yields on 10-year Treasuries fell considerably to 0.67% from 0.85% while traditional bond indices rose. Treasury yields fell as virus fears spread and investors try to protect against increasing risk. An additional layer of influence on treasury yields is the newly passed federal stimulus bill. Treasury yields will continue to be a focus as analysts watch for signs of changing market conditions.

High-yield bonds dropped again this week, causing spreads to loosen. High-yield bonds are likely to remain volatile in the short to intermediate term as the Fed has adopted a remarkably accommodative monetary stance and investors flee virus risk factors, likely driving increased volatility.

Lesson to Be Learned

“The individual investor should act consistently as an investor and not as a speculator. This means … that he should be able to justify every purchase he makes and each price he pays by impersonal, objective reasoning that satisfies him that he is getting more than his money’s worth for his purchase.”

-Ben Graham

It can be easy to become distracted from our long-term goals and chase returns when markets are volatile and uncertain. It is because of the allure of these distractions that having a plan and remaining disciplined is mission critical for long term success. Focusing on the long-run can help minimize the negative impact emotions can have on your portfolio and increase your chances for success over time.

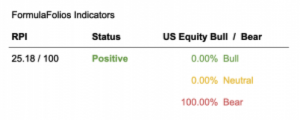

We have two simple indicators we share that help you see how the economy is doing (we call this the Recession Probability Index, or RPI), as well as if the US Stock Market is strong (bull) or weak (bear).

In a nutshell, we want the RPI to be low on the scale of 1 to 100. For the US Equity Bull/Bear indicator, we want it to read least 66.67% bullish. When those two things occur, our research shows market performance is strongest and least volatile.

The Recession Probability Index (RPI) has a current reading of 25.18, forecasting further economic growth and not warning of a recession at this time. The Bull/Bear indicator is currently 0% bullish – 100% bearish, meaning the indicator shows there is a slightly higher than average likelihood of stock market decreases in the near term (within the next 18 months).

The Week Ahead

Global governments have begun shutting borders and restricting economic activity, likely driving increased volatility. We expect large price swings as markets continue to process developments surrounding the coronavirus. The economic calendar includes updated consumer confidence numbers as well as new unemployment claims.

More to come soon. Stay tuned.