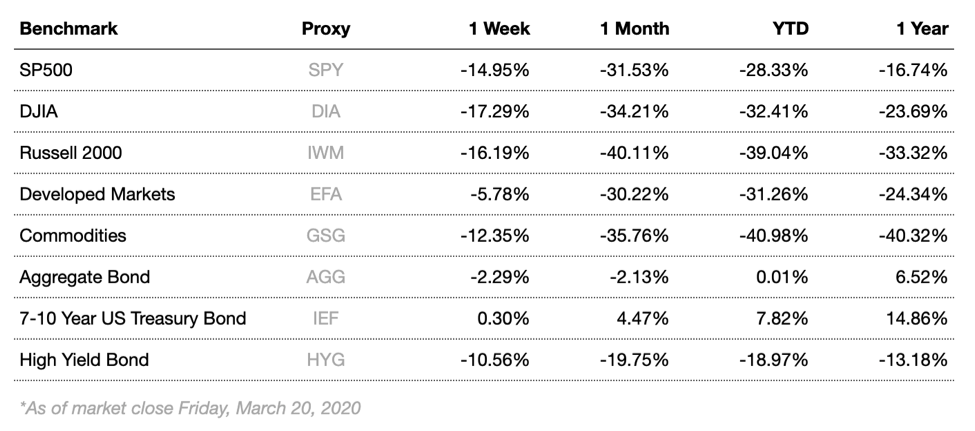

Markets fell dramatically this week as the novel coronavirus Covid-19 continued its spread, prompting shutdowns and quarantines around the globe. The oil dispute between Saudi Arabia and Russia has continued, as both countries have vowed to flood the oil market with cheap inventory until the opposing party agrees to terms. Saudi Arabia has declared its intent to pump oil with no limits beginning in April. For the second consecutive week, no sector was spared from the decline as governments globally have begun implementing drastic measures to slow the spread of the virus. Consumer staples led the S&P sectors this week with the smallest losses, finishing ahead of communications and consumer discretionary to round out the strongest sectors. Markets have officially entered bear market territory resulting from developments regarding the spread of the Covid-19 coronavirus, as new cases have continued emerging around the globe. Public anxiety is growing as the virus continues to spread. Adding further pressure to markets and global supply chains are the increasing government measures being taken to contain new cases. A large and increasing percentage of consumers and workers are staying home. Investors are facing challenges trying to determine market impact, as government actions to try and overcome the disease are constantly evolving.

Overseas, markets echoed U.S. indices, as European markets declined sharply. Italy has been hit especially hard by the virus, as they have the oldest average population in Europe. All major European indices returned negative results. Japanese equities also returned negative performance, continuing recent trends. New cases of the coronavirus have been growing at increasing rates in Europe, causing elevated volatility and increased selling pressure on assets.

Markets fell dramatically this week, with all major equity indices bringing in negative returns. Fears concerning global stability and health are an unexpected factor in asset values, and the recent volatility serves as a great reminder of why it is so important to remain committed to a long-term plan and maintain a well-diversified portfolio. When stocks were struggling to gain traction last month, other asset classes such as gold, REITs, and US Treasury bonds proved to be more stable. flashy news headlines can make it tempting to make knee-jerk decisions, but sticking to a strategy and maintaining a portfolio consistent with your goals and risk tolerance can lead to smoother returns and a better probability for long-term success.

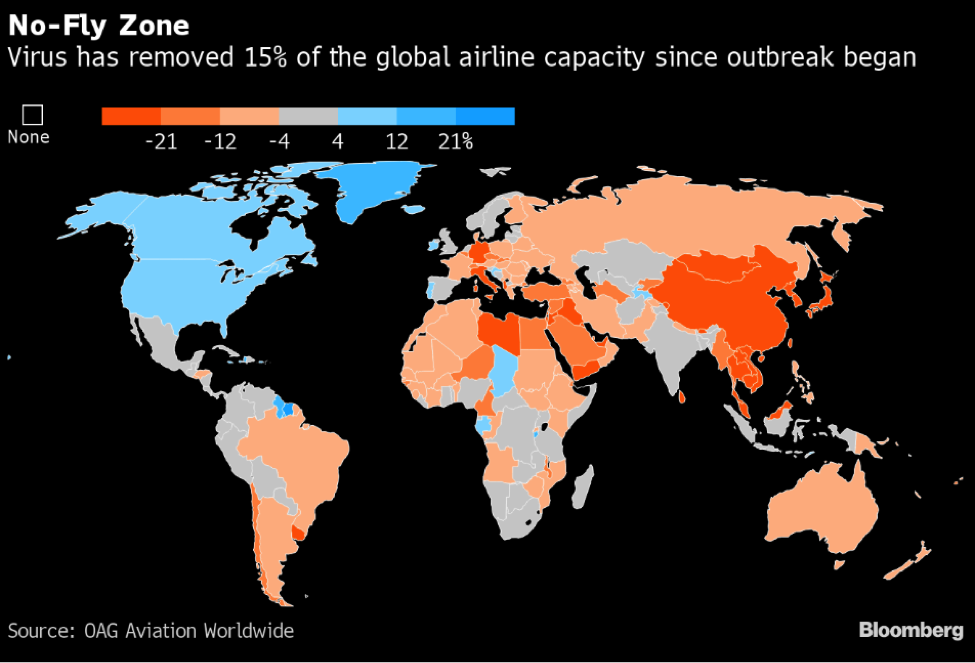

Chart of the Week

Since the outbreak of the Covid-19 coronavirus, the airline industry has been in a state of freefall. Capacity has been dramatically cut to try and weather the crisis. Government bailouts are expected to be introduced to help the struggling industry.

Market Update

Equities

Broad market equity indices finished the week down, with major large cap indices performing comparably to small cap. Recent fears weighed heavily on equities this week, as prices declined in response to virus developments. Economic data has begun to reflect the damage inflicted by the disease, as manufacturing indices and retail sales dropped substantially.

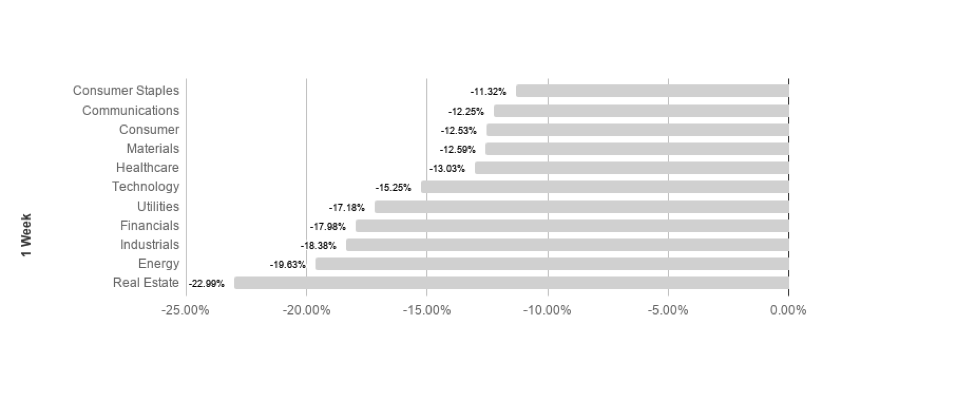

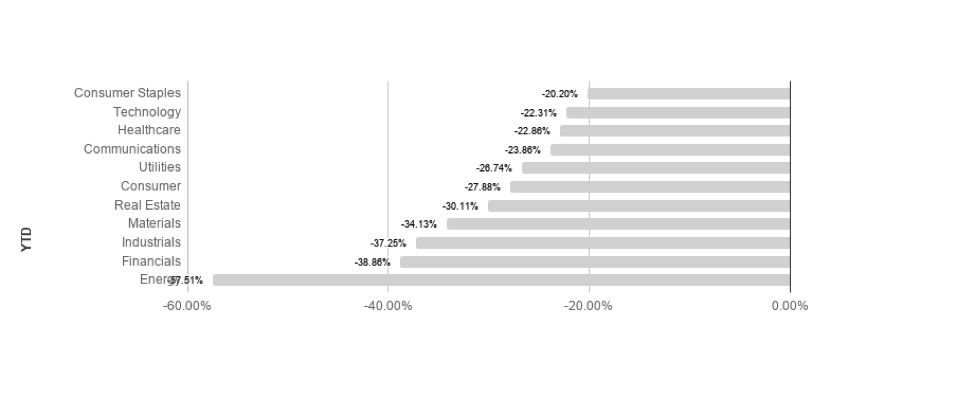

S&P sectors returned sharply negative results this week, as broad market movements showed investors moving to reduce risk. Consumer staples and communications led the best performing negative sectors returning -11.32% and -12.25% respectively. Real estate and energy fell the most, losing -22.99% and -19.63% respectively. Consumer staples leads the pack so far YTD, returning -20.20% in 2020.

Commodities

Commodities dropped this week, driven by further dramatic losses in oil and natural gas. Oil markets have been highly volatile, with investors focusing on geopolitical tension and global demand concerns. Global fears surrounding the virus outbreak have further stoked demand concerns, as a significant impact on energy demand is expected as a result. Additional pressure has been added to oil markets as Saudi Arabia and Russia have entered into a price war over production disputes.

Gold fell this week as fear surrounding the coronavirus increased. Gold is a common “safe haven” asset, typically rising during times of market stress, but is currently breaking from traditional price movements during these unusual Covid-19 spurred circumstances. Focus for gold has shifted to global macroeconomics and public health concerns.

Bonds

Yields on 10-year Treasuries declined to 0.85% from 0.96% while traditional bond indices fell. Treasury yields fell as virus fears spread and investors try to protect against increasing risk. The 10-2 year yield spreads loosened. Treasury yields will continue to be a focus as analysts watch for signs of changing market conditions.

High-yield bonds dropped this week, causing spreads to loosen. High-yield bonds are likely to remain volatile in the short to intermediate term as the Fed has adopted a more accommodative monetary stance and investors flee virus risk factors, likely driving increased volatility.

Lesson to Be Learned

“Investors should purchase stocks like they purchase groceries, not like they purchase perfume.”

-Ben Graham

It can be easy to become distracted from our long-term goals and chase returns when markets are volatile and uncertain. It is because of the allure of these distractions that having a plan and remaining disciplined is mission critical for long term success. Focusing on the long-run can help minimize the negative impact emotions can have on your portfolio and increase your chances for success over time.

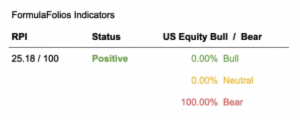

We have two simple indicators we share that help you see how the economy is doing (we call this the Recession Probability Index, or RPI), as well as if the US Stock Market is strong (bull) or weak (bear).

In a nutshell, we want the RPI to be low on the scale of 1 to 100. For the US Equity Bull/Bear indicator, we want it to read least 66.67% bullish. When those two things occur, our research shows market performance is strongest and least volatile.

The Recession Probability Index (RPI) has a current reading of 25.18, forecasting further economic growth and not warning of a recession at this time. The Bull/Bear indicator is currently 0% bullish – 100% bearish, meaning the indicator shows there is a slightly higher than average likelihood of stock market decreases in the near term (within the next 18 months).

The Week Ahead

Global governments have begun shutting borders and restricting economic activity, likely driving increased volatility. We expect large price swings as markets continue to process developments surrounding the coronavirus. The economic calendar includes updated durable goods numbers as well as new unemployment claims.

More to come soon. Stay tuned.